The 7 most exclusive bank cards in SA and their cost

Updated | By Jacaranda FM

And how much you need to earn in order to put one in your wallet...

You often hear the rich and famous talk about "black cards" and other fancy bank cards.

READ: 20-year-old makes history by representing SA in rugby and cricket

Not only do these exclusive cards exist, but you have to earn an exceptional amount even to get close to owning one.

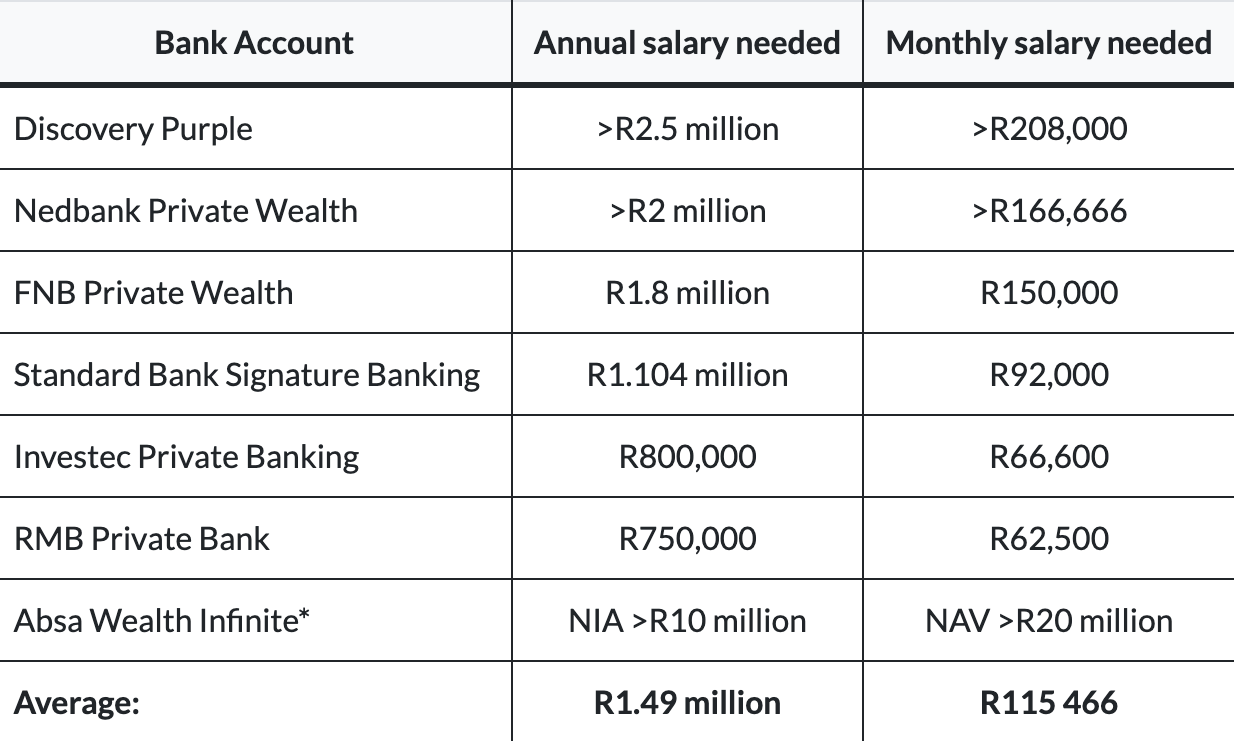

Some of these cards require a minimum monthly income of R62,500.

According to BusinessTech, the most appealing part of owning these cards is the exclusive benefits, the status associated with it and, essentially, the bragging rights.

WATCH: Stay in this Airbnb and run a book store!

The cards listed below are designed for high-income earners, VIP customers, and the type of money some of us will never see in our lifetime.

BusinessTech reports that these cards' owners must be within SA's top 7% of income earners. Some require prospective customers to be firmly in the 1%.

WATCH: Viewers react to "insecure" woman getting mad at her man

Knight Frank's Wealth Sizing Model says in annual terms you need to earn at least $109,000 (R1,93-million) to be considered in the top 1% in SA.

Here are the most exclusive bank cards in the country and how much you need to earn to be eligible to own one:

*Absa’s most exclusive Wealth (Visa) Infinite credit card terms of eligibility are measured in Net investible assets (NIA) and Net asset value (NAV).

WATCH: South African "creates" local version of 'Grand Theft Auto'

Discovery Purple is not only the highest annual salary but also the highest monthly fee at R684.

Here are some of the perks connected to these cards:

Discovery Purple

-

One monthly fee includes all transactions and flexible credit facility

-

Unlimited free savings accounts

-

Real-Time Forex Accounts available 24/7 via the app

-

Vitality Money rewards programme with personalised incentives

-

Flight discounts:

-

Up to 75% off international and local flights

-

Up to 75% off international business class flights

-

-

Travel perks:

-

Free multi-trip international travel insurance

-

Unlimited global airport lounge access

-

Fast-track airport security (OR Tambo, Cape Town)

-

-

Lifestyle & cashback benefits:

-

Up to 75% back on HealthyFood at Pick n Pay, Woolworths

-

Up to 50% back on HealthyCare at Clicks, Dis-Chem

-

Up to 20% back on Uber and fuel at BP/Shell

-

Up to 40% off when spending Discovery Miles

-

Up to 75% off Nike gear and fitness devices

-

Up to 50% off Technogym home equipment rentals

-

-

Service excellence:

-

Dedicated relationship banker

-

Exclusive Purple Servicing channel and Concierge

-

Nedbank Private Wealth

-

Complimentary airport lounge access

-

24/7 concierge service for lifestyle and travel

-

Emergency travel assistance

-

Discounts on accommodation, car rental, and meet-and-assist services

-

High-value travel insurance: Up to $2.5 million

-

Greenbacks Rewards:

-

Up to 2 Greenbacks per R10 with Visa Infinite

-

Double Greenbacks with Amex cards

-

-

Dedicated private banker

-

Specialist team for wealth management

-

Private Wealth App access

FNB Private Wealth

-

Comprehensive financial integration (banking, investment, insurance, lending)

-

Dedicated Private Advisor and expert support team

-

Advanced digital tools via FNB App

-

Tailored investment solutions

-

eBucks Rewards with extensive travel discounts:

-

Up to R20,000 in travel savings annually

-

Up to 40% off local/international flights, car hire, bus tickets

-

Up to 36 SLOW Lounge visits/year (+24 extra if flights booked via eBucks)

-

-

Access to FNB travel desk for exclusive deals

-

Expertise in global investing, succession planning, commercial property

Standard Bank Signature Banking

Travel and Lifestyle Benefits

-

Unlimited complimentary access to:

-

OR Tambo Library Lounge (includes one guest + kids under 2)

-

Standard Bank Fluent Lounge at Lanseria International Airport

-

1,300+ international lounges via the Mastercard TravelPass App

-

-

Flight and travel discounts:

-

Up to 20% off Emirates flights (via Leisure Desk)

-

Up to 35% off Avis international car rentals

-

Up to 10% off local car rentals via Rentalcars.com

-

-

Hotel and accommodation perks:

-

Up to 15% discount on IHG Hotels & Resorts across Europe, Maldives, India, Middle East, and Africa

-

Up to 15% cashback on Booking.com hotel bookings

-

Up to 15% off luxury serviced apartments

-

-

Wine Club offer:

-

15% off when spending over R500 at Wine-of-the-Month Club

-

UCount Rewards

-

R25/month for UCount membership

-

Earn more UCount Points using the World Citizen Credit Card

-

Qualify for Tiering Points when opening a Platinum Optimum offshore bank account

Investec Private Banking

-

Unlimited Rewards points (no fees, no expiry)

-

Airport perks via InTransit App and lounge access

-

Prime-linked interest rate

-

Up to 45 interest-free days on card purchases

-

Unlimited free ATM withdrawals locally/internationally

-

Interest earned on positive balances

-

Budget facility (up to 60 months)

-

Free extra card or discounted spouse account

-

Free Youth Account with debit card

-

Linked Cash Management Account for higher interest

-

Investment options for children and tax-free accounts

-

UK sterling account (optional with fee)

-

Preferential forex rates

-

Emergency cash abroad via Western Union

-

Exclusive travel service

-

Access to:

-

Investec One Place

-

Investec Digital

-

Investor Rewards

-

RMB Private Bank

-

Metal card with full credit facility

-

Single interest rate, 30 days interest-free

-

Linked additional/spousal accounts

-

Comprehensive financial services (banking, investment, lending, insurance)

-

Strong personal advisory relationships

-

Specialised focus on:

-

Intergenerational wealth

-

Global investing

-

Sustainable finance

-

-

Access to eBucks Rewards

-

SLOW Lounge access

-

Cash@Till, exclusive VISA offers

-

FNBy accounts for youth

Absa Private Banking

-

Wealth Bundle Account: One monthly fee covers most services

-

Exclusive Wealth Infinite Credit Card (black metal card)

-

Up to 30% cashback via Absa Rewards

-

Dedicated team: Wealth Banker, Investment Manager, Fiduciary Specialist

-

50% discount on spouse account

-

Up to 57 days interest-free on credit card purchases

-

Unlimited access to:

-

Domestic Bidvest Premier Lounges

-

International lounges via Visa LoungeKey (1 free guest/visit)

-

-

Insurance benefits:

-

Travel insurance, Buyers Protection, Extended Warranty, Rental Car Collision Damage Waiver

-

-

Concierge and Global Client Services

-

Visa Luxury Hotel Collection access: VIP rates, upgrades, extra perks

-

Up to 35% Avis rental discounts

-

YQ airport meet-and-assist service

-

Stockbroking on 31 global exchanges

-

Personalised estate planning & high-value insurance

Tune in to 'The Drive with Rob & Roz', on weekdays from 16:00 – 19:00. Stream the show live here or download our mobile app here.

Listen to Jacaranda FM:

- 94.2

- Jacaranda FM App

- http://jacarandafm.com

- DStv 858/ OpenView 602

Follow us on social media:

Main image courtesy of Pexels

More on Jacaranda FM

Show's Stories

-

The dangerous consequences of texting and driving

While cellphones are meant to improve our lives, they have also become a...

The Workzone with Alex Jay 5 hours ago -

Check out this functional life-size Lego car

One of the best-equipped Lego cars ever...

The Workzone with Alex Jay 5 hours ago